Blogs

How Estate Agents can beat the doom and gloom of 2023

Wherever you look the experts are predicting an annus horribilis for Estate Agents next year. But we’ve unearthed some ways you can beat the property market slump and thrive next year

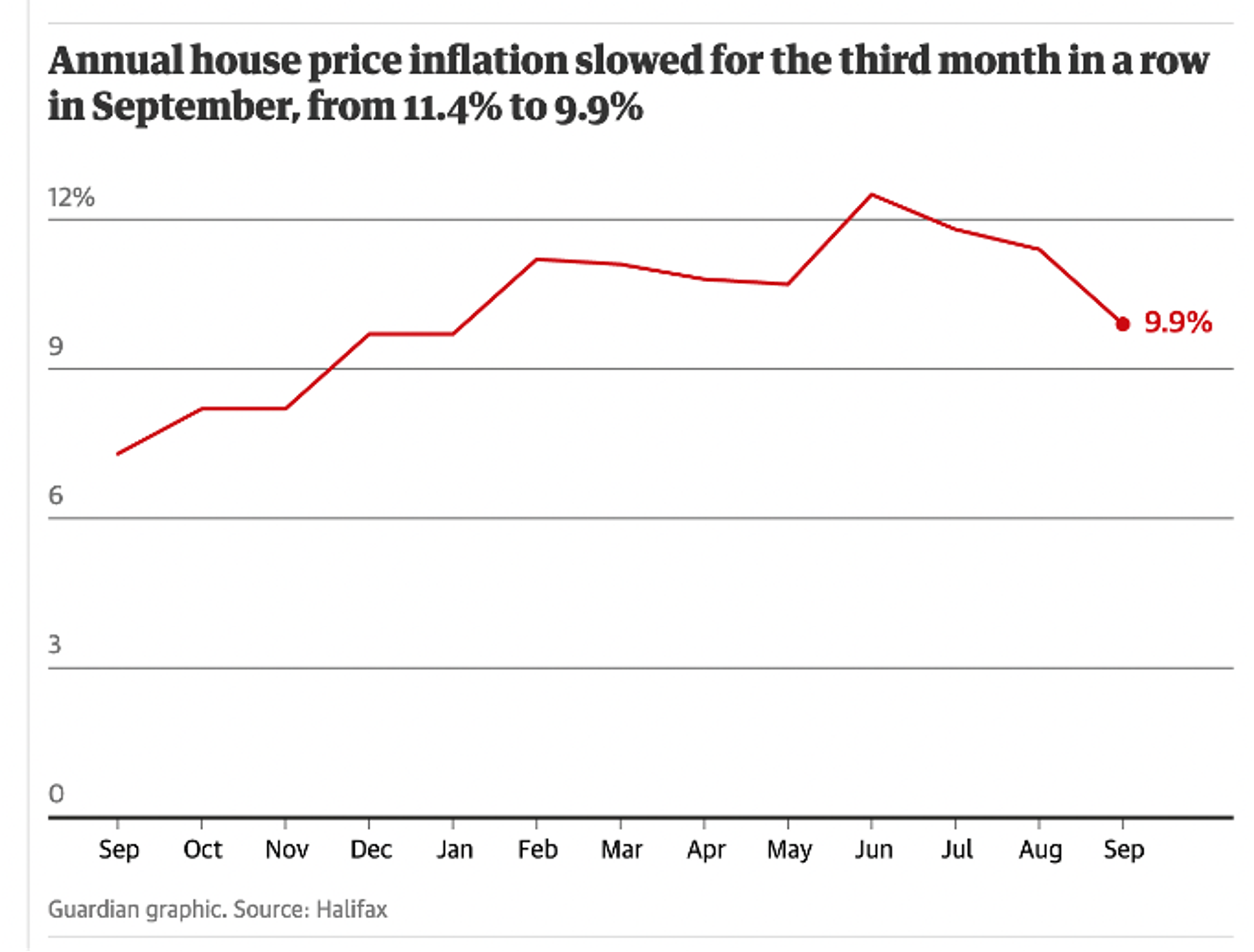

Who would be an estate agent these days? Everywhere you look are experts painting a picture of abject misery for at least the next 12 months, and probably longer. Knight Frank says 10%. Savills says 10%.

Graham Cox, founder of the Bristol-based broker SelfEmployedMortgageHub.com, reckons it will be 20% based on new data from the building society Nationwide.

While the Royal Institution of Chartered Surveyors (RICS) report predicts that the UK’s 13-year housing boom will come to an end. Homeowners will struggle to make mortgage repayments and repossessions will rise next year, it said.

The number of inquiries from potential homebuyers fell for a fifth month in a row in September, while sales fell to the lowest level since May 2020 when the housing market all but ground to a halt during the early stages of the coronavirus pandemic.

UK’s 13-year housing market boom to end in 2023, surveyors predict

So what can you do about it? While the natural reaction of most estate agents is to deal with an economic downturn in the same way they would handle a hurricane — hunker down, don’t take any unnecessary chances and try to survive until it is over – there are ways to mitigate the worst aspects of the next 12 months and even put your agency in the best possible shape to take advantage once the worst is over.

We’ve compiled three ways to survive the downturn in 2023… and possibly even steal a march on the competition.

Don’t contract – expand

Ashley Romiti (https://realestatewritingforyou.com/), founder of Real Estate Writing for You (https://realestatewritingforyou.com/), says:

“When the market changes, real estate agents need to shift their business model. Expand your territory a little bit, look outside your normal geographic area and outside your normal price ranges, and find where people are still buying and selling.”

In tough times, consider those hit hardest and come up with ways you can help them. Think of preforeclosures, expired listings, or even divorce leads.

Done right, this can be a generous source of qualified leads that can fill your pipeline indefinitely. Building relationships with leading law firms (who are looking for ways to survive and thrive in 2023 too, remember – LINK to the article already written for legal firms) in your local area can provide plenty of opportunities to get first dibs on at-risk properties.

At the very least look to expand your target area. In a world governed by digital property listings and virtual viewings (started in the pandemic and still preferred by many clients (https://www.propertyreporter.co.uk/property/e-areas-of-the-uk-that-offer-the-most-virtual-viewings.html)) there’s no reason to stay committed to your traditional local territory.

Keep talking

In every recession marketers find themselves in poorly charted waters because no two downturns are exactly alike. However, in studying the marketing successes and failures of dozens of companies as they’ve navigated recessions from the 1970s onward, Harvard Business Review (https://hbr.org/2009/04/how-to-market-in-a-downturn-2) identified patterns in consumers’ behaviour and firms’ strategies that either propel or undermine performance.

During recessions, of course, consumers set stricter priorities and reduce their spending. As sales start to drop, businesses typically cut costs, reduce prices, and postpone new investments – and marketing is usually the first to go. That’s a mistake.

Sam Stovall of CFRA Research says: ‘when we do finally fall into a recession, that’s usually a good time to get back into the market’. And it’s weirdly true – as your competitors hunker down and cut their mail drops and digital ads to save costs, that gives you so much more room to showcase why your agency is better, and different. It projects confidence to those in a downturn who need to buy or sell their home regardless of the market conditions (due to a change in job or circumstance, and so on).

Although it’s wise to contain costs, failing to support brands or examine core customers’ changing needs can jeopardize performance over the long term. Companies that put customer needs under the microscope, take a scalpel rather than a cleaver to the marketing budget, and nimbly adjust strategies, tactics, and product offerings in response to shifting demand are more likely than others to flourish both during and after a recession.

Invest in decent technology

As the saying goes, don’t get too busy to do the things that got you busy. Setting up your customer relationship management (CRM) to keep track of your prospects, clients, and leads in today’s property space is essential.

Focus your marketing efforts on people who will need your services three, six, or even 12 months from now. That will help fill your pipeline with clients and keep your business healthy.

The CRM will work as an assistant, reminding you of important facts about your clients, what you discussed in your last conversation, and when you need to follow up. We couldn’t manage our estate agency without our CRMs. They do a lot of heavy lifting.

APLYiD has relationships (LINK to our partners page) with many CRM databases including Salesforce, Reapit, and Alto (by Zoopla) so you can use our tools automatically within your existing CRM workflow. It makes life much easier to manage and removes a lot of unnecessary paperwork.

But new technology doesn’t stop there. A downturn means you can use the slower time to get things set up to run without you having to be at the helm constantly. Brush up on your livestreaming and virtual tour skills. If you’re lacking in the area, sign up for some accelerated courses to acquire these skills quickly.

And – of course – invest in the best possible client onboarding software. With an 88% pass rate and checks completed in under sixty seconds, APLYiD is a totally paperless, automated way of verifying your customers’ identities with no need for data entry or chasing clients for ID documents.

To find out more about our biometric onboarding and verification software, you can get in touch here.