Blogs

AML vs KYC explained: What professionals need to know

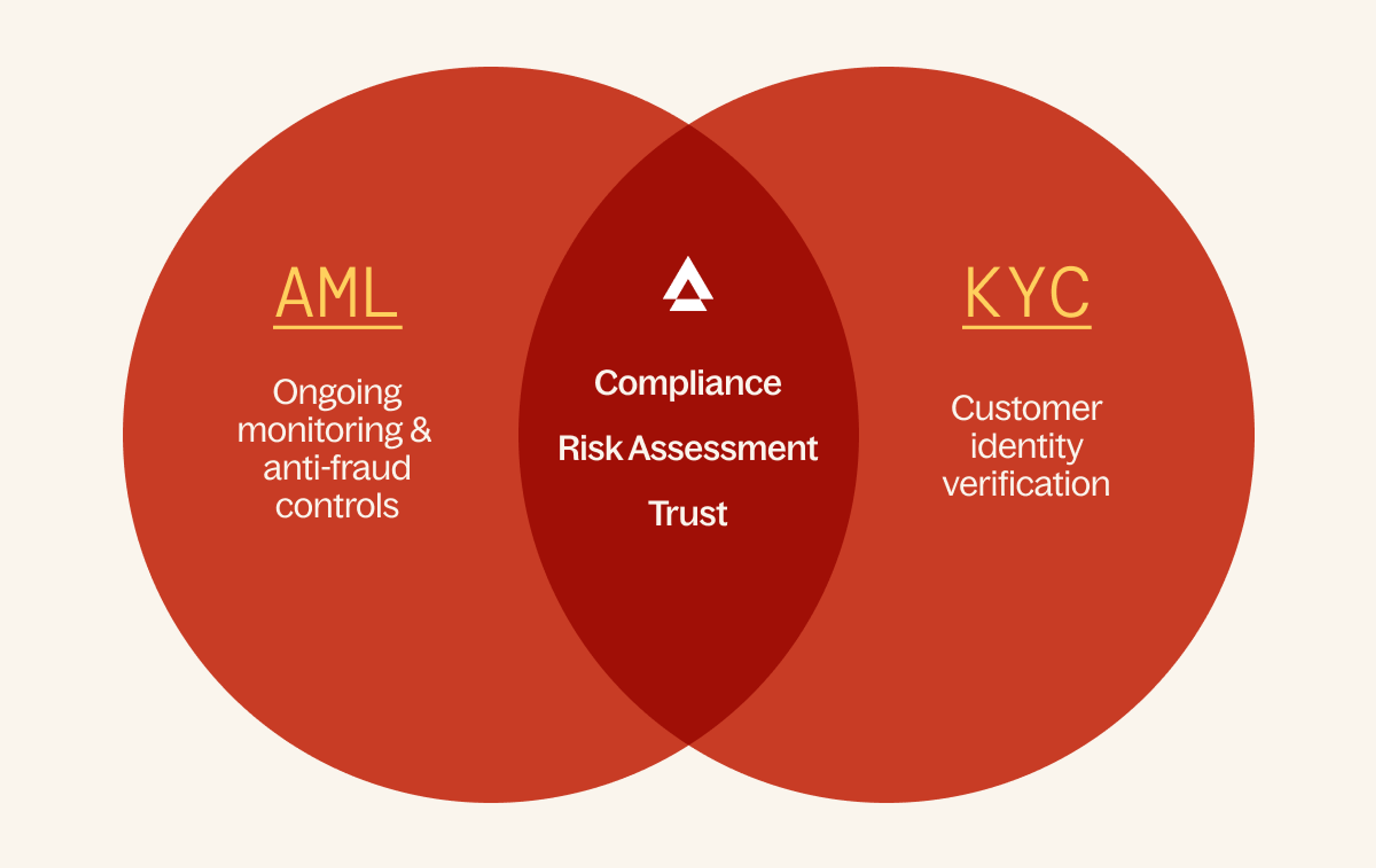

Anti-money laundering (AML) and know your customer (KYC) work helps prevent financial crime and counter terrorism. Similar but different, it’s crucial for professionals working in industries like real estate, legal, accounting, and financial services to understand the difference between the two concepts, what you need to do, and the impact of ignoring them.

KYC forms a significant part of AML, so we’ll look at that first.

KYC – fully understand who you’re doing business with, verify your customers and identify red flags.

KYC is a key part of AML regulation. KYC checks are a collection of steps that help businesses fully understand their customers through identifying data.

It means that as part of your onboarding process, you get to know – and verify – the individual or organisation before you do business with them. It’s important you collect the right and accurate info to avoid risk to your business.

In doing this, you’ll prove your customer is who they say they are. If the entity is an organisation or trust, you will verify that it does exist. And because of this process, you’ll also be serving your customers better. Not to mention it helps you sleep easier as things don’t fall through the cracks.

You’ll get to know what your customer’s ‘normal’ is and unusual or suspicious transaction types or amounts will become an instant red flag. This knowledge helps you reduce the risk to your business of being caught up in money laundering and terrorism crimes.

In a nutshell, when you follow KYC properly you:

- Authenticate your customers

- Onboard your clients with confidence

- Comply with regulation

- Assess risk levels

- Prevent fraud

- Reduce your risk of exposure to financial crimes – like money laundering, terrorist financing and identity theft

Beyond that, KYC makes good business sense – it helps build your customers’ trust and safeguards your reputation.

AML – what it is, the global scale of the issue, and why it matters to you.

Money laundering is a financial crime which involves cash being ‘cleaned’ by a criminal entity. Using a series of steps the money is introduced into the financial system in several clever – and increasingly sophisticated – ways. The result? In a way it appears as if ‘dirty’ money has been through the wash – it comes out clean, looks legitimate and can be used to fund other forms of crime.

The UN reports, “The estimated amount of money laundered globally in one year is 2-5% of global GDP, or $800 billion – $2 trillion in current US dollars.”

To put this in perspective, if you were to stack the money peddled every year, the pile would reach halfway to the moon.

AML rules, regulation and procedures are not about red tape – they are in place to prevent money laundering from being possible.

When you follow AML regulation properly you:

- Establish and verify identity

- Manage risk on an ongoing basis

- Make audit time simple

- Complete your customer due diligence

- Screen for sanctions and politically exposed persons (PEPs) against databases and lists to recognise – and mitigate – any likely threats.

- Protect yourself from exposure to money laundering.

When you follow AML, you’re doing your bit to combat money laundering crime. Having seamless AML processes in place allows you to achieve all this with minimal disruption.

Read on to see how APLYiD makes all this possible (and your life way easier).

TLDR: For those of you on the clock.

- For most businesses, compliance isn’t about catching criminals or even preventing fraud - it’s about protecting your team, your time, and your reputation

- Every business has clear responsibilities when dealing with customers.

- KYC is a major part of those responsibilities.

- All this means you avoid costly regulatory penalties.

At the end of the day, if you don’t meet your AML responsibilities, you’re not just risking fines - you’re risking your ability to operate smoothly.

There are three major consequences of getting it wrong:

- Operational risk - when AML becomes a manual burden, your staff get bogged down in paperwork and repetitive checks. This slows onboarding, frustrates teams, and ultimately chokes your pipeline. As one legal director put it: “It’s not our job to catch the bad guys, we just want to make sure this doesn’t become a bottleneck that slows down business.”

- Regulatory risk - falling short of your obligations means risking heavy penalties or even prosecution. While that might not feel urgent today, it only takes one audit or one flagged client for things to get very real, very fast.

- Reputational risk - if your clients experience delays, unclear requests, or clunky onboarding, they start to lose trust. In a competitive market, that’s a fast way to lose both new and repeat business.

APLYiD allows you to meet your regulatory obligations and steer you away from the risks.

Now you’ve seen the scale of the challenge – let’s give you the answer.

APLYiD is the no nonsense solution to all your AML and KYC processes. With APLYiD you gain:

1) Confidence in your AML and KYC procedures. APLYiD allows you to spot high-risk clients, perform due diligence, and flag suspicious activities.

With APLYiD, AML and KYC steps won’t fall through the cracks. You gain a full audit trail and ongoing monitoring without the need to sift through spreadsheets and piles of paperwork.

2) Simplicity for you and your clients: APLYiD is a self-serve platform with zero hassle that gives you guided compliance workflows for every client.

When it’s time to verify them, your clients receive a text message with simple steps to complete (which they can do from the comfort of their couch). You can verify in minutes – without the need for lining up schedules, travel, or storing paper files.

3) Everything you need in one platform: Effective onboarding, biometric identity verification, AML, and KYC in one platform. APLYiD gives you the world’s best biometrics, PEP checks and more.

4) Speed: With APLYiD you get your time back to focus on your core business, thanks to instant client onboarding and a staggering 94% pass rate.

In minutes, APLYiD makes your life way easier thanks to:

- A seamless self-serve platform with the world’s best biometrics

- No contracts, no demos, no setup costs

- Guided compliance workflows for every client

- Full audit trail and ongoing monitoring

- Free support when you need it

Take KYC and AML compliance off your mind